The Bison and the Bows

Trade and Civilization

Thousands of years ago, tribes formed as a means to survive and thrive on the lands they found themselves in. Some had access to rivers and oceans. Others were in mountains, forests, plains or even deserts. Each tribe adapted to their surroundings, and were effectively competing for their existence with the birds, bees, bears and trees. At this stage, humanity was as wild as the tigers trying to hunt them down for food.

One day, two tribes ran into each other. One had successfully hunted two bison, and were carrying the two carcasses back to their camp. The other tribe had no food, but were in possession of a dozen powerful bows with razor sharp arrows which the bison hunters thought would make their hunting a lot easier. A deal was struck.

They agreed to swap one of the bisons for 5 bows, each equipped with a couple of arrows. At that moment, the transaction established a price between bison and bows. This was a monumental trade, and both tribes benefited from the exchange. What motivated the exchange is today known as the social science of catallactics.

News of the transaction permeated throughout the land. Some people immediately went on the hunt for more bison in the hope of exchanging them for 5 bows. Others applied their skill sets to producing more bows, but also other hunting tools that would make bison hunting easier. In other words, tribesmen began supplying more bows and bison that stimulated an immediate increase in supply and demand. The local economy started booming.

The adventurous tribesmen began exploring other regions to exchange their goods for other products that would help their own population with food, shelter and security. These people became traders, and the successful traders began walking the same paths to places they knew would yield successful transactions. These became known as trade routes.

Because each tribe lived in slightly different geographical conditions, there was always something one region would have in abundance that another tribe needed, and vice verse. There were only so much bison one could eat, and only so many tools that one tribe needed. Therefore, supply and demand would reach a homeostasis that allowed for the slow and steady growth of each tribe.

Some tribes were very successful, while others were not. For fear of complete annihilation, some tribes began to migrate to more successful places. This would lead to inevitable conflict, but gradually humans began coexisting in larger numbers in places that were abundant in natural resources, or in places where numerous tribes could meet to exchange their goods. As the population boomed, these places became villages, towns, and eventually cities.

The more transactions that took place, the price signals acted as a motivator for people to produce things and supply them to their local economies. Prices, therefore, got people busy, and they were able to survive and thrive with their respective businesses.

Wherever the most transactions occurred was where the wealthiest people congregated to participate in trade. The excess wealth afforded them the luxury of forming their own security to protect their people from threats, as well as allocating capital to innovating new products that could exponentially grow their wealth.

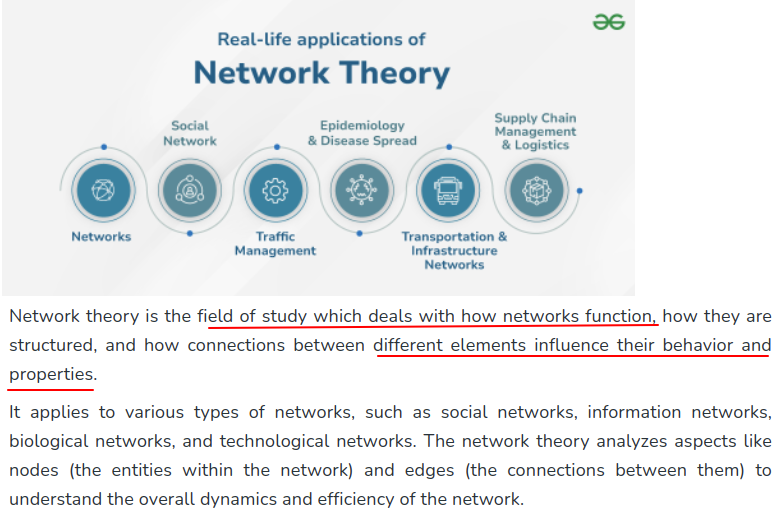

The establishment of towns and trade routes created a network of commerce that connected everyone to goods and services produced from all over the place. These networks allowed for the exponential growth in transactions because they could connect with people that would otherwise be isolated and unable to trade with each other.

Today, the establishment of towns and trade routes can be explained through the study of Network Theory.

Transactions depended on the ability for people to form relationships in order to trade. If there were 10 people in a region, 45 separate relationships could be formed. However, if there were 100 people, this number exploded to 4950 possible relationships that could be established. Therefore, a ten fold increase in population created a 100 fold increase in trade potential. This is how the most populated regions exploded in wealth and commerce. Gradually, the wealthiest players in a region established the best security forces, and they declared the territory under their control.

The noble rulers of a region lived a precarious existence. In order to protect their status, they needed to maintain a small army to defend against potential enemies. If they did not invest in self-defence, they would eventually be taken over. There was also the problem of maintaining law and order within their territory. If their towns were rife with crime, it would be too risky for traders to enter into their territory to trade. Additionally, the residents would begin to migrate away to safer places. If this occurred, trade within their region would collapse, along with the ruler’s wealth and power.

Therefore, the administration of a region required funds to maintain the economic viability of its towns and villages. It was at this point small fees needed to be charged by the ruler to finance his newly formed government. If the fee was too high, people would flee or overthrow the ruler. If the fee was too low, the ruler could not maintain his territory. Taxation, therefore, became an art form.

To summarize, transactions of all types of goods and services established prices. These prices motivated others to participate in trade and supply more goods to the market place. The economic wealth thus created motivated the wealthiest in the regions to become kings, who vowed to protect their subjects and maintain order. Kings needed to impose taxes to maintain their rule, and the most successful king managed to tax the people as little as possible, but enough to maintain their wealth and power.

Trade, therefore, became the bedrock of civilization and requires resources, innovation and productivity to grow. Thereafter, the art of taxation became all pervasive.

A Brief History of Taxation

The concept of tax is not a new invention. It has been around since the birth of civilization. In days of old, taxation was levied on the People as a means to finance government. However, if the taxes were too high, a ruler risked uprisings, revolutions and their family’s lives. Today, the base of taxation has never been broader, and our governments have never been more inefficient. How has this occurred?

For millennia, taxation was generally levied as a toll on trade. A trader would bring goods to and from a town, where a fee was charged, similar to a toll. The toll would still allow the traders to make a good profit when selling their goods. In addition, the price paid for those goods in the local marketplace by residents would be affordable. If the toll was too high, traders would no longer bring their goods into the marketplace, and the local economy would suffer. There was always a fine balance between the toll charged and the prosperity of the town.

In Europe, these taxes were generally levied by territories known as Burgraves or Margraves.

As we have noted in previous articles, the beginning of the Hohenzollern dynasty started as the Burgraviate of Nuremberg. Taxes could be levied by the military governors, and so these territories became income producing assets for the rulers. Furthermore, these assets could be handed down through the generations, and also bought and sold like real estate by the noble classes.

This is how the Hohenzollerns grew their original empire. From the Burgraviate of Nuremberg, to the Margraviate of Brandenburg, and eventually to the Kings of Prussia, princes of the House of Orange.

Trade based taxation, however, severely limits the local governor’s spending capabilities. Many noble houses collapsed when their debts outpaced the tax income they were receiving, and they were forced into selling their territories. Furthermore, there were local residents within their territories who were making lots of money as merchants and bankers and were escaping the grips of the taxman. Enter the concept of income tax.

Income tax allowed the local governor to not only tax the trade of goods coming in and out of their territory, but also the profit generated within its borders. Furthermore, income tax forced local residents to declare their assets and incomes to the local authorities. This provided the governor with a birds-eye view of who was making the most money, and how. Therefore, local merchants were now contributing to the administrative costs of the Burgraves. Over time, those who still prospered under this system were lifting themselves out of poverty, and into a new middle class. A colloquial term was attributed to them:

This is how the Hohenzollerns and other noble houses were able to finance permanent standing armies. Local residents were conscripted into the military to serve their masters, and the taxes went towards training, arming, feeding and deploying armies across Europe.

While this was nothing new, the Hohenzollerns were masters at taxation and warfare, which is why they grew into the most powerful force in Europe, ultimately culminating in their crowning as Kaisers of the German Reich. Interestingly, their namesake declared exactly that:

Sometimes the most obvious things are hidden in plain sight. Perhaps it is purely a coincidence that the Hohenzollern name relates to “high taxes”, but there is no doubt that the dynasty were master tax collectors, rising to power while those around them collapsed.

From trade and income taxes, the base of taxation has gradually expanded from there. Sales taxes, death taxes, exit taxes and many other taxes have crept into the lexicon that is tax. However, they are all based from a single principle. That principle is that you must have something of worth before you pay tax.

Traders paid tolls to enter the village market place. Therefore they owned goods that they believed would generate a profit in the future when sold into the market.

Income taxes are collected based on income. Therefore you must earn money first before you can pay the tax. Other taxes also require the payer to have capital in the first place before collection can occur.

Today, there is a new tax in town. Not based on trade, income or assets, but on your very existence as a human being.

Carbon taxes are designed to collect tax on the very things that keep humans alive. The energy we use and the food we eat are all targeted to be taxed before we make a single penny. Therefore, the poorest pay the most in this tax-maniacal shitshow.

In yet another amazing coincidence, one of the most predominant “scientific” institutes in the world promoting this quackery is based in Potsdam; the very place where Frederick the Great built his beloved “Sans, Souci.”, and where his bones were relocated just before the birth of the EU.

The founder of the Potsdam Institute of Climate, or PIK, is also close friends with King Charles.

For those who are familiar with previous #PrussiaGate articles, we found it amusing that PIK is Dutch slang for “dick”. With all this talk of “Sans, Souci.”, King Charles and carbon taxes, we are beginning to realize that all of these tax-obsessed merchants of climate doom are simply dickheads.

This provides a brief history of how taxation has gradually broadened to eventually tax the very essence of life itself. No matter how much tax we pay, the monies raised from all taxation goes into a general ledger which must first pay off those from whom the empire has borrowed.

In other words, it will always first go toward financing the ever-ballooning sovereign debt.

None of this, of course, will ever solve the debt problem because tax collection requires an expanding and costly bureaucratic force to administer the extraction of wealth from We the People. Today, this is going to come in the form of AI surveillance driven smart-city gulags.

This may all sound a little Orwellian, because it quite literally has become so. When a government is able to expand without any checks or balances, there will be no stone left unturned as taxation falls into the hands of Scamocrats. We the People must become super vigilant and remain Awake to the scam that is unfolding. The punishment for not being Awake is, predictably, more tax.

The Linearization of a Non-Linear Scamocracy

Today, the size of nation state bureaucracies has grown into unsustainable behemoths. Their primary function as government administrators has morphed into a sea of regula# The Linearization of a Non-Linear Scamocracy

Today, the size of nation state bureaucracies has grown into unsustainable behemoths. Their primary function as government administrators has morphed into a sea of regulatory garbage that continually requires the extraction of private citizens’ wealth to fund its existence. The art of doing business is continually bogged down with regulations, licensing, and taxes. These taxes primarily go towards financing the bureaucracies as well as the national debt.

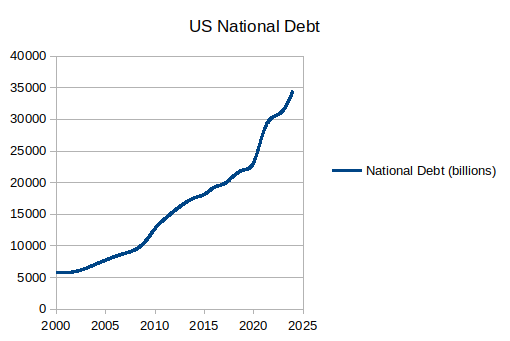

Over the last few decades, sovereign debt has exploded around the world. In part 1, we showed how the explosion of American national debt runs parallel to the parable of the Great Rice Contract, and will eventually collapse the Republic if the current system is not overhauled very soon. While other nations find themselves in similar situations, the US should concern everybody because it has the world’s reserve currency.

What this effectively means is that other central banks around the world hold US dollars in their reserve, and print their own currencies off the back of these reserves. Whats more, global trade is financed predominantly using US treasuries. Therefore, if the US dollar were to collapse, or if the US government were to default on their loan obligations, global trade would potentially collapse, taking down many sovereign nations with it.

Therefore, it is paramount to the entire world that the US does not collapse, no matter what anyone thinks about the American political landscape. Under the O’Biden Kamala klownshow, the explosion of the national debt was coupled with an equally large explosion in the size of the bureaucracy, and collapse looked a near certainty.

How did this happen? The Federal Reserve facilitated the issuance of government debt while the Biden regime drastically expanded the tax and regulatory system. This resulted in a new power-law of an exponentially growing government while We the People suffered with more taxation, inflation and private sector job destruction. The end-goal was to collapse the current system, and then “build back better” with a new smart-city, AI driven, carbon tax gulag system.

In other words, through central banking and taxation, we were financing our own doom. At the same time, NGOs and others who received lucrative contracts from the ballooning spending of government have become insanely wealthy. The Western world was in the brutal death throws of a globalist Scamocracy.

That is, until President Trump and his team arrived back on the scene.tory garbage that continually requires the extraction of private citizens’ wealth to fund its existence. The art of doing business is continually bogged down with regulations, licensing, and taxes. These taxes primarily go towards financing the bureaucracies as well as the national debt.

Over the last few decades, sovereign debt has exploded around the world. In part 1, we showed how the explosion of American national debt runs parallel to the parable of the Great Rice Contract, and will eventually collapse the Republic if the current system is not overhauled very soon. While other nations find themselves in similar situations, the US should concern everybody because it has the world’s reserve currency.

What this effectively means is that other central banks around the world hold US dollars in their reserve, and print their own currencies off the back of these reserves. Whats more, global trade is financed predominantly using US treasuries. Therefore, if the US dollar were to collapse, or if the US government were to default on their loan obligations, global trade would potentially collapse, taking down many sovereign nations with it.

Therefore, it is paramount to the entire world that the US does not collapse, no matter what anyone thinks about the American political landscape. Under the O’Biden Kamala klownshow, the explosion of the national debt was coupled with an equally large explosion in the size of the bureaucracy, and collapse looked a near certainty.

How did this happen? The Federal Reserve facilitated the issuance of government debt while the Biden regime drastically expanded the tax and regulatory system. This resulted in a new power-law of an exponentially growing government while We the People suffered with more taxation, inflation and private sector job destruction. The end-goal was to collapse the current system, and then “build back better” with a new smart-city, AI driven, carbon tax gulag system.

In other words, through central banking and taxation, we were financing our own doom. At the same time, NGOs and others who received lucrative contracts from the ballooning spending of government have become insanely wealthy. The Western world was in the brutal death throws of a globalist Scamocracy.

That is, until President Trump and his team arrived back on the scene.

A CCP Power-Law Parable

The evolution of taxation is a critically important concept in understanding and appreciating the steps that have been taken by the Trump administration. While the imposition of partially reciprocal tariffs has led to wild gyrations in the financial markets, they have hit the globalist Scamocrats where it hurts them the most.

On the whole, We the People have been left with very little savings to invest in capital markets. Furthermore, regulations have forced many industries to close their operations down and migrate to places which do not tax or regulate at the same rates. The biggest benefactor of this scam has been the CCP, who has provided its citizens as slave labor to globalist corporations. They are exempt from the carbon tax regime, and generate some of the cheapest energy on the planet – even though China is a major importer of energy from resource rich nations like Australia.

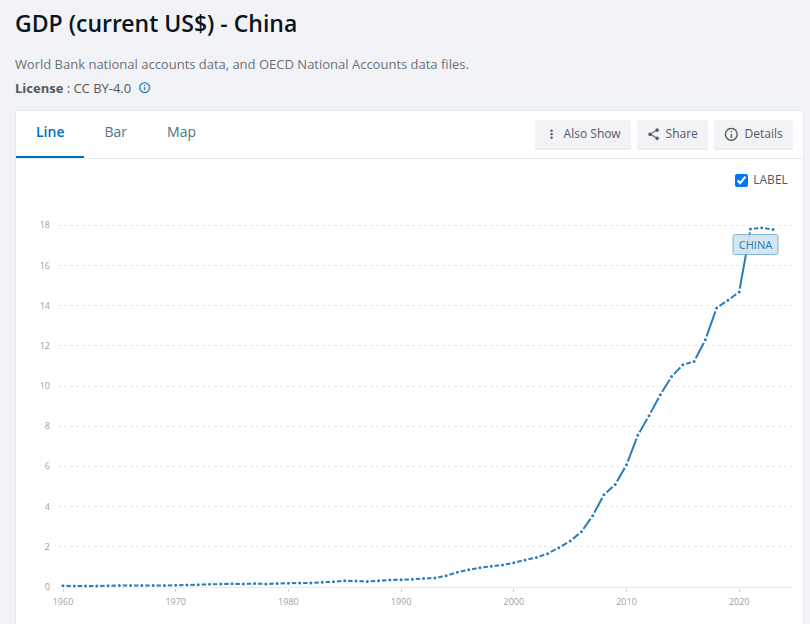

As a result, profit margins of corporations which have moved their manufacturing bases to China have experienced fantastic growth. This in turn has fuelled a massive stock market boom and generated many billionaires in the process. In 2001, when China officially entered the WTO, their GDP was just over US $1 Trillion. Two decades later, they are now the second largest economy in the world:

Contrast the rise of the CCP with the rise in US national debt, and it starts to become clear where the CCP wealth came from:

China did not grow because of innovation or productivity. They grew out of the West’s obsession with taxation, regulation and government inefficiency. As the Western world taxed the daylights out of its citizens, they also imposed huge climate change restrictions on business operations. China, of course, was exempt from the climate tax regime. It was a no-brainer for globalist corporations. They moved their operations to China, capitalized on slave labor and cheap, dirty energy, and sold the goods back to America for a fabulous profit.

It was the mother of all scams and it was bankrupting Western governments in the process. That is, until the reciprocal tariffs arrived!

Time to Reduce Size and Linearize?

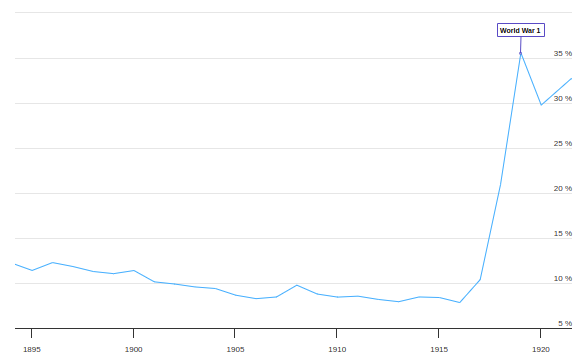

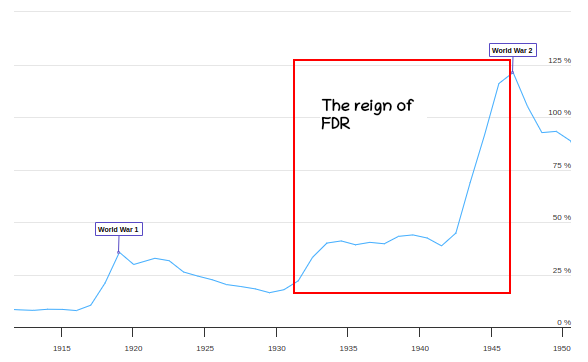

When the Federal Reserve and income tax system was introduced back in 1913, it allowed the growth of the federal bureaucracy to decouple from the American economy. If the government needed money, they were no longer dependent on revenue from tariffs and duties. They could tap into the bond market, go into debt, and rely on income taxes to pay off the debt in the future. Only a few years after 1913, when America was dragged into WWI, the power of government debt became self-evident.

While some may argue that the role of the United States in WWI was necessary to stop the German campaign in its tracks, we have shown in many #PrussiaGate articles that it sparked a new era in Western geopolitics. It was at this moment that the US government bond market became a permanent part of the global investment landscape. Whenever the federal government required money over and above their annual tax revenue, the bond market would supply them with whatever extra funds they needed. WWI showed the awesome power and influence the US could have over the rest of the world.

After the Federal Reserve goosed the stock market during the roaring 1920s, the inevitable crash and depression that followed allowed President FDR unlimited access to funds via the bond market. He rapidly expanded the federal bureaucracy, and a plethora of new permanent agencies were established. As the people suffered terribly through the Great Depression, the growth of government continued to expand unabated. The cost of this government growth was to be paid back by the taxes of future generations.

The reign of FDR let the proverbial “cat out of the bag”, and academic economists all over the world applauded the role of an expansionary government to save We the People. The problem, however, was that the money raised by government had to go somewhere. Not only did they provide their public servants with generous salaries and pensions, but globalist corporations now sought to get a piece of the action with lucrative contracts. Whats more, We the People financed the entire klownshow with new and creative forms of taxation.

Nations from around the world joined in on the orgy of debt and tax. Governments were no longer constrained, and they could grow exponentially at the expense of We the People. A new power-law emerged, where the growth of government and globalist corporations completely dislocated from the growth and prosperity of the average citizen.

Put simply, we are living in a global Scamocracy where big government and the corporations that serve them revel in trillion dollar deals while We the People struggle to pay for food, shelter and security. Since the 1970s, regulations are used to hinder our business activities and redirect industrial production to places that provide the cheapest energy and labor. Today, the CCP has been the largest beneficiary of this insanity.

President Trump’s tariffs on China now claws back the profit margins that were shipped offshore and provides a massive incentive to bring back manufacturing into the US. But in order to “make manufacturing great again”, America needs cheap energy, and lots of it. Fortunately, America has all the energy it needs. Therefore, as Trump unravels the ridiculous regulatory hurdles of energy production, he also creates an even better incentive for manufacturing to return to the US.

Trump has also touted the elimination of the Internal Revenue Service for an External Revenue Service. If income taxes were severely reduced, or eliminated altogether, American taxpayers would be left with more money in their back-pockets to consume and/or invest. Whats more, every new manufacturing job creates 4 or so other jobs in marketing, sales, management and logistics. Demand for American labor would skyrocket, while income taxes on their salaries plummet.

Tariffs, however, cannot be too high to discourage trade. It is a delicate balancing act that still encourages trade and investment in America. Therefore the size of government must necessarily fall back into line with the tariff revenue it generates. Today, the federal government is awash with inefficient agencies and outright scams that fleece We the People out of our hard earned income.

In order for this ambitious restructuring of the American system to reach fruition, the size of government must be reduced enormously. The DOGE is doing a fantastic job at exposing the scams that have been occurring within elements of the federal bureaucracy and NGOs receiving billions for nothing. It can best be described in the words of the irrational weirdo, Maxine Waters:

Maxine is emblematic of the serial Scamocrat class. Their greatest fear is the unveiling of their various scams that have turned them into multi-millionaires while earning humble public servant salaries. In order for tariffs to work, these scams must be purged from the system, root and branch.

Earlier in this article we highlighted the origins and evolution of taxation. It began with tariffs, or tolls that villages charged in order for merchants to participate in the local marketplace. In a tariff based system, if a government wants tax revenue it can only do so by allowing business and trade to flourish. Consequently, the size of government can no longer grow exponentially as We the People suffer under draconian tax-maniacal scams. It must now be linearized with the private sector economy.

In order for President Trump to truly usher in a new Golden Age, the size of government must be severely reduced at the same time the private sector heavily invests in manufacturing and trade. The bureaucratic class no longer rules over We the People, but instead must work hard to ensure private businesses are given every opportunity to expand and employ as many people as they require.

What’s not to like about that proposition? When it comes to governance, is it finally time to reduce size and linearize?

Regardless, the enemy knows all too well the consequences of Trump’s policies. The ultimate battle has yet to be fought, and the “Creature from Jeckyll Island” will continue to do everything in its power to stop a new Golden Age from coming into fruition.

To be continued…

-

https://mises.org/mises-daily/scope-and-method-catallactics ↩︎

-

https://www.geeksforgeeks.org/real-life-applications-of-network-theory/ ↩︎

-

https://dictionary.cambridge.org/dictionary/german-english/bourgeoisie?q=Bourgeoisie ↩︎

-

https://www.wordhippo.com/what-is/the-meaning-of/german-word-9dbc6e2e2ea4238088cba0e9d672e8ee9aee00f8.html ↩︎

-

https://dictionary.cambridge.org/dictionary/german-english/zoll ↩︎

-

https://www.weforum.org/stories/2021/06/addressing-climate-change-through-carbon-taxes/ ↩︎

-

https://www.pik-potsdam.de/en/news/latest-news/climate-fee-on-food-could-effectively-cut-greenhouse-gas-emissions-in-agriculture-while-ensuring-a-social-balance ↩︎

-

https://www.dailymail.co.uk/femail/article-14110817/King-Charles-traditional-maori-nose-rub-st-james-palace.html ↩︎

-

https://www.zerohedge.com/political/far-left-maryland-democrats-just-passed-sleep-tax-next-thinking-tax ↩︎

-

https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=CN ↩︎

-

https://www.cnn.com/2025/04/17/economy/trump-fed-chair-powell-termination/index.html ↩︎